Key Takeaways

- Form 1040 is the main IRS document U.S. taxpayers use to report income, deductions, and credits, resulting in tax owed or refund due.

- There are multiple versions—like 1040‑SR for seniors and 1040‑NR for nonresidents—and the right one depends on your situation.

- To fill it out, gather all your income data first (W‑2s, 1099s, K‑1s, etc.), then download the correct version, complete any needed schedules, and file.

- Tax software and practice management tools can speed this up—systems like Karbon or Xero integrate dirty work behind the curtain so you can focus on filing.

Introduction

If you’re filing U.S. taxes—or you’re the CPA managing returns for clients—knowing Form 1040 inside out is essential. It’s the foundation for everything: income, deductions, credits, refunds, and amounts due. Sure, it looks simple if someone earns a paycheck only. But once you toss in side gigs, itemized deductions, or multiple businesses, it gets complicated fast. In this guide, we’ll break it down: what each version of Form 1040 does, when you use it, and how to fill it out right. Let’s get started.

What Is a 1040 Tax Form?

Form 1040 is the IRS’s standard document used to report annual income and figure out federal taxes due—or a refund. It’s where wages, interest, dividends, self‑employment earnings, itemized deductions, and credits all come together. Whether you’re a W‑2 employee, a freelancer with a 1099, or involved with investments, you’ll likely use this form.

Attention to detail matters here. You need to collect every W‑2, 1099, K‑1, and deduction receipt—charitable donations, mortgage interest, student loan payments—anything that impacts your tax liability. Missed info can mean missed deductions, or even trigger audit questions. So treat Form 1040 as the hub of your return—a one‑stop for everything you report to the IRS.

Types of IRS Form 1040

The IRS offers several versions of Form 1040, and picking the right one matters:

- Form 1040: The standard version for most taxpayers—reports income, deductions, credits.

- Form 1040‑SR: Made for filers age 65 and up. Same content, larger type and simplified layout.

- Form 1040‑NR: Nonresident aliens with U.S. income use this to report federal tax obligations.

- Form 1040‑X: An amendment form if you need to correct a filed return.

- Form 1040‑ES: Helps estimate and pay quarterly taxes on income without withholding (like freelance work).

- Form 1040‑V: Payment voucher to use if mailing in a paper return and owing tax.

Choosing the right version upfront keeps things smooth—and cuts down on correction work later.

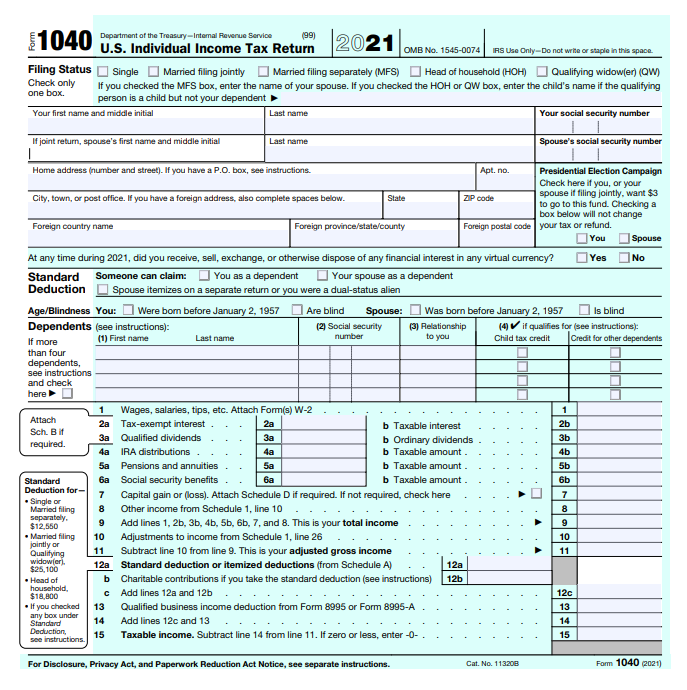

How to Fill Out Form 1040: Practical Instructions

Here’s a refined, step‑by‑step rundown:

- Collect Basic Info

Ensure you have full legal name, SSN, date of birth, filing status, and dependent details. - Gather Income Documents

W‑2s, 1099s, K‑1s, unemployment 1099‑G, plus investment docs like 1099‑INT or 1099‑DIV. - Retrieve Insurance and Deduction Records

Forms 1095‑A/B/C for healthcare, plus records for charitable gifts, mortgage interest, education costs, and more. - Download the Correct Form

Choose the form version you need—main 1040, 1040‑SR, or others—and review the instructions. - Fill Out Schedules as Needed

- Schedule 1: Extra income (like self‑employment) or adjustments (student loan interest).

- Schedule 2: Additional taxes, such as self‑employment or AMT.

- Schedule 3: Nonrefundable credits (e.g., education or foreign tax).

- Schedule A: Itemize deductions—medical, state taxes, mortgage interest.

- Schedule B: Interest and dividend income over limits.

- Schedule C: Business profit/loss for self‑employed.

- Schedule D: Capital gains/losses from investments.

- Schedule E: Rental or royalty income.

- Schedule SE: Self‐employment tax calculation.

- Transfer Totals to 1040

Move summed numbers from your schedules into the main form: income totals, deductions, credits. - Double‑Check Everything

Make sure names, SSNs, and numbers match your source docs. A typo here could delay processing.

IRS Form 1040 Deadlines

Filing Form 1040 on time is critical. For most taxpayers, the due date falls on April 15. But when that date lands on a weekend or public holiday, the deadline shifts to the next business day. In 2024, that meant most filers had until April 15, while Maine and Massachusetts had until April 17 due to Patriots’ Day.

If you’re overseas or serving in the Armed Forces, you might qualify for an automatic extension. Still, extensions only delay the filing deadline—not the deadline to pay what you owe.

Tip: Even if you can’t afford to pay your full tax bill, filing on time helps avoid additional penalties.

Strategies for Maximizing Deductions

One of the best ways to reduce your client’s tax bill is by helping them take full advantage of legal deductions. Here are a few key areas to keep in mind:

- Itemize when it makes sense: While many filers opt for the standard deduction, some may save more by itemizing. Look closely at things like mortgage interest, medical costs, and charitable donations.

- Max out retirement savings: Contributions to a 401(k) or traditional IRA can lower taxable income.

- Track education expenses: Credits like the American Opportunity Credit or Lifetime Learning Credit can reduce taxes owed.

- Deduct business expenses: If your client is self-employed, they can often deduct business-related costs—think office supplies, travel, and software.

- Use an HSA: Contributing to a Health Savings Account can reduce taxable income while helping with medical costs.

A good rule of thumb? Don’t just look for deductions at tax time—encourage clients to plan for them all year.

Efficient Management of Multiple 1040 Filings

When tax season ramps up and you’re juggling multiple returns, working smarter—not harder—makes all the difference. Staying organized is half the battle.

Start by getting documents from clients early. Store everything digitally—cloud folders, client portals, whatever works best for your flow. That way, when it’s go time, you’re not stuck chasing down paperwork.

A smart move? Use standardized templates. If you’re filing for similar clients—like sole proprietors or those with rental income—have forms pre-filled with common deductions or income lines. It saves time and cuts down on mistakes.

Batch similar returns together, too. Handling multiple freelancers or real estate investors? Process them as a group. It keeps you consistent and saves mental energy.

And don’t forget to set firm deadlines. Clients aren’t always aware of the prep involved, so it’s on you to be clear about when you need their stuff. Gentle nudges early on can prevent a mad dash in April.

Finally, don’t sleep on good tax software. Tools like ProConnect or Drake Software aren’t just fancy calculators—they help you track progress, automate entries, and cut through clutter. A few smart upgrades can pay for themselves in time and sanity.

Other Tax Forms You May Need

Filing a 1040 rarely happens in a vacuum. Depending on your client’s situation, you’ll probably need to attach supporting forms. Here’s a quick look at the usual suspects:

- Form W-2: Reports wages, tips, and salary. This one’s non-negotiable for employees.

- Form 1099-NEC: If your client works freelance or has contract gigs, this form reports their non-employee earnings.

- Form 1099-DIV: Shows dividend income from investments. Common for clients with stocks or mutual funds.

- Form 1098: Tracks mortgage interest paid—key for itemized deductions.

- Schedule C: For those with business income, especially sole proprietors and side hustlers.

- Schedule SE: Calculates self-employment tax.

- Schedule A: Where you list out itemized deductions if not taking the standard deduction.

Knowing which forms to include can help prevent filing delays or unwanted letters from the IRS. And for seasoned tax pros, staying sharp on these details keeps everything running smooth.

Final Words

Filing Form 1040 might look intimidating at first glance, especially when you’re managing several clients at once, but it doesn’t have to be overwhelming. The real key is structure—knowing what documents you need, using the right tools, and having a repeatable process in place.

Once you’ve got a system that works—digital folders, pre-built templates, solid software—most of the grind disappears. That leaves you with more room to focus on the details that really matter: minimizing tax liability, spotting deduction opportunities, and keeping your clients out of hot water.

In the end, the 1040 is just a framework. What makes it work is how well you manage everything around it. Get that part right, and tax season gets a whole lot easier to handle—no matter how many returns are on your desk.